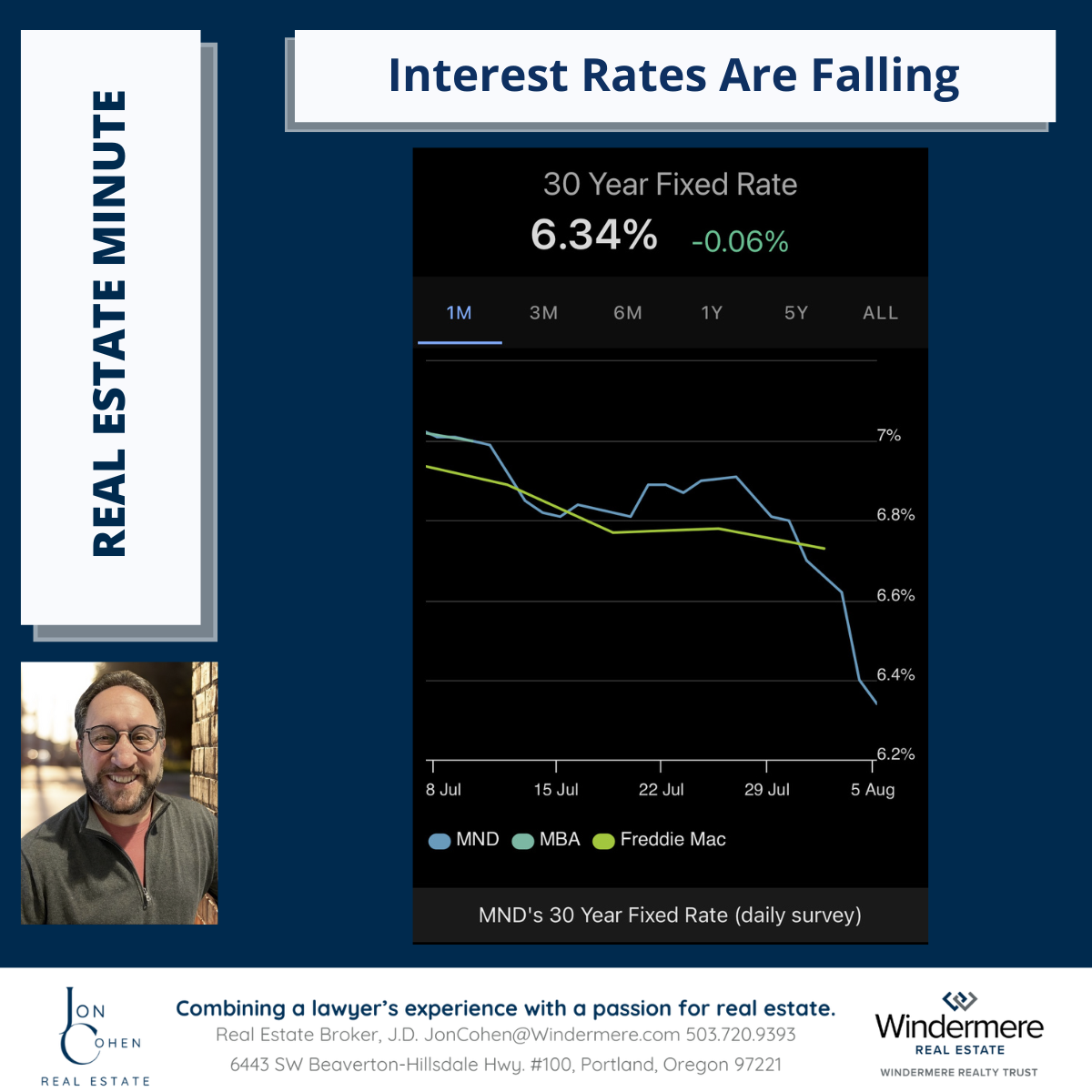

Today was a big day for mortgage interest rates. Providing a positive vibe for the housing market, the average interest rate for 30-year mortgages dropped to 6.34%, the lowest rate since April 2023. The lower rates will help homebuyers concerned about affordability which in turn provides sellers with a bit more comfort about giving up their very low interest rate mortgages when they purchase their next home. With each 1% drop in interest rates, buyers gain approximately 10% more buying power.

Sellers have struggled with giving up their low interest loans and many decided to stay in their homes rather than sell. This contributed to the low inventory of homes available to buyers. At the same time, buyers have struggled with affordability issues as high interest rates combined with higher prices due to the limited supply of homes. There is hope that as interest rates come down, we will see more "elective" sellers put their homes on the market, and more buyers will be able to afford to purchase.

Will interest rates continue their downward trend? We'll have to wait and see. It's possible that the lending community is building in lower rates before the Federal Reserve takes action in September. Or the markets could be reacting to other economic factors and could lower rates if and when the Fed lowers its rate. Some economists have predicted increased real estate activity if interest rates come down to 6%, which is not too far away. The whole real estate industry will be waiting with anticipation.