When interest rates were at historic lows, a typical fixed-rate mortgage loan was all most people needed. Now, with rates appreciably higher, buyers’ monthly mortgage rates are much higher. As the real estate market adjusts to changing interest rates, buyers and sellers are looking to make homes more affordable, and lenders are helping with interest rate buydown loans.

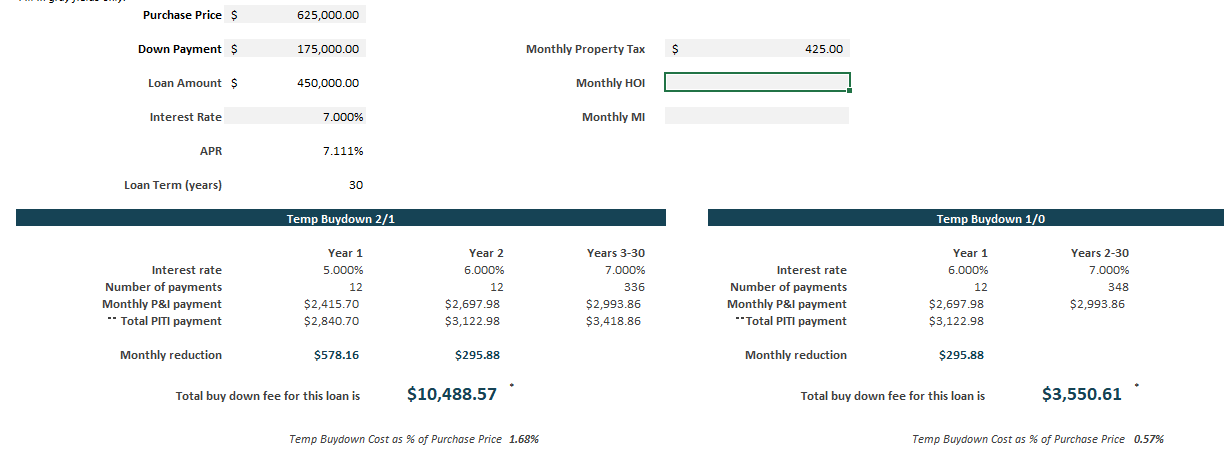

For a home that has been on the market for a while, the seller could lower the price $25,000, OR offer a $10,500 credit to buy down the mortgage interest rate, saving $14,500 and creating a more affordable monthly payment for the buyer. The illustration below is an example of how an interest rate buydown can save the buyer money each month.

In this example – a “2/1 Buydown” – the buyer will get a 30-year fixed rate loan with an interest rate that’s discounted 2% during the first year and 1% the second year. The buyer will ease their way into a new home with lower payments that simply step up at the end of the first and second year, and then remain fixed for the remainder of the loan.

This is just one way today’s buyers can make buying the home they really want a reality. At the same time, sellers can offer an incentive to buyers without a dramatic price reduction. If you have any questions or would like to learn more, let’s talk.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link