Seller Series, Part 6: Showings and Open Houses — What Happens Once Your Home Goes Live

So, you’re thinking about selling your home in 2026. Part 6 of my multi-part Seller Series – Preparing Your Home For Sale in 2026 – will give you a look at how we use open houses and personal showings to bring in as many potential buyers as possible. Part 1 focused on Starting Early and Making a First Impression. Part 2 addressed living in your home while selling or marketing the home vacant. Part 3 was all about Staging and Photography. Part 4 highlighted our Pricing Strategies. Part 5 introduced you to how I market your home.

Seller Series, Part 6: Showings and Open Houses — What Happens Once Your Home Goes Live 🏡

Once your home is active on the multiple listing service, the next phase begins: getting buyers through the door. By this point, most buyers have already seen your home online. Now they want to step inside, get a feel for the space, and imagine their life unfolding there. This stage is exciting, a little unpredictable, and absolutely essential to attracting the right buyer.

Here’s what to expect — and how we’ll navigate it together.

First Look: From Online Browsing to In‑Person Impressions 👀

Buyers typically encounter your home online first. High‑quality photos, floor plans, and virtual tours help them decide whether it’s worth seeing in person. Once they’re intrigued, they’ll either attend an open house or schedule a private showing through their Realtor.

Their goal is simple: Does this home feel right? Our goal is equally simple: Make it easy for them to find out.

Open Houses: Creating Momentum and Access 🚪

Open houses are one of the most effective ways to generate early interest and energy around your listing.

Thursday Broker Tour 🤝

Windermere brokers preview new Windermere listings each Thursday. This gives agents a chance to see your home before bringing their clients — and often sparks early conversations and referrals.

Opening Weekend: Saturday + Sunday📅

I like to host open houses on both days of your first weekend on the market. This is when buyer curiosity is highest and when many people are actively touring homes.

You’ll see a mix of visitors:

- Buyers seeing the home for the first time

- Buyers returning for a second look

- Neighbors who may know someone looking

- Agents gathering intel for their clients

After the first weekend, the frequency of open houses is entirely up to you. I’m happy to host additional ones, and if I’m unavailable, I can arrange for a trusted Windermere colleague to step in.

Agent Previews and Private Showings 🔑

Some agents — myself included — like to preview a home before bringing clients. It helps us determine whether the home is a good match and how to position it in the context of the buyer’s needs.

When time is tight or demand is high, we’ll schedule private showings directly with the buyer present. These appointments are typically 30 minutes and give buyers the chance to explore the home at their own pace.

Scheduling Showings: Flexibility Helps, but You’re Always in Control 📲

If the home is vacant, showings are easy to accommodate. If you’re living in the home, we’ll work together to create a schedule that respects your routines while still giving buyers access.

A few things to know:

- You approve every showing time (unless you prefer I handle approvals for you).

- The more flexible you can be, the more buyers we can accommodate.

- We’ll use an online scheduling system that keeps everything organized and transparent.

You can choose whether showing requests come directly to you or through me first — whatever makes the process smoother for your household.

Safety and Security: How We Protect Your Home 🔒

Every showing is tracked through a secure lockbox system. Only licensed agents with verified credentials can access the key, and every entry is logged. You’ll always know who has been in your home and when.

The Hardest Part: Living in a Home That’s Always “Show‑Ready” 🧺

This is the part every seller feels. When you’re still living in the home, keeping it tidy and ready for last‑minute showings can be the most challenging aspect of the entire process.

A few strategies help:

- Create a quick‑reset routine for surfaces, floors, and bathrooms

- Use baskets or bins for fast clutter pickup

- Keep a “showing bag” ready so you can step out easily if needed

- Remember: this phase is temporary — and it pays off

Buyers aren’t expecting perfection, but they do respond to homes that feel clean, calm, and cared for.

What This Stage Really Means ✨

Showings and open houses are where your home stops being a listing and starts being a possibility for someone else. It’s where momentum builds, where buyers fall in love, and where the right offer begins to take shape.

My job is to make this stage as smooth, predictable, and stress‑free as possible — and to ensure every buyer has the opportunity to see your home at its best.

Let’s Talk!

If you’re thinking about selling this year and want a clear, step‑by‑step plan — not guesswork — I’d love to walk you through the process. Every home, timeline, and seller is different, and I’m here to make sure you feel prepared, supported, and confident from the first showing to the final signature. Reach out anytime if you’d like to talk strategy or explore what selling could look like for you.

Seller Series – Preparing Your Home For Sale in 2026 – Part 5: How I Market Your Home

🏡 Seller Series, Part 5: How I Market Your Home

When I bring a home to market, I’m not just uploading a listing and hoping for the best — I’m launching a coordinated campaign designed to create urgency, attract qualified buyers, and position your home to shine. Great marketing is about timing, competition, and strategy, and every step I take is intentional.

Here’s how I approach marketing your home from the moment we decide to list.

📸 First Impressions Start with Photography

Buyers make decisions in seconds, and many of those decisions happen online. That’s why professional photography (which I covered in Part 3 of this series) is the foundation of everything I do. Clean, bright, accurate photos set the tone for the entire campaign and make sure your home stands out from the moment it hits the market.

🌐 Online Syndication: Casting a Wide, Strategic Net

Once your listing goes live on the Regional Multiple Listing Service (RMLS), it automatically syndicates to dozens of real estate websites — Zillow, Redfin, Realtor.com, brokerage sites, and more. This ensures your home is visible wherever buyers are searching.

But I don’t rely on syndication alone. I make sure your listing includes:

- High‑quality photos and video

- A floor plan and 3D tour

- A clear, factual description that highlights what matters, avoiding the fluff and poetic frosting created by AI.

My goal is to give buyers the information they need to say, “I want to see this one.”

📱 Social Media: Building Buzz Where People Already Are

Social media is one of the fastest ways to get eyes on your listing — buyers’ eyes, as well as the eyes of neighbors, friends, and agents who may know someone looking in your area.

I share:

- “Just Listed” announcements

- Open house invitations

- Behind‑the‑scenes prep or staging moments

- Short videos or reels that highlight key features

When appropriate, I also tap into neighborhood hashtags, local groups, and community networks to expand your reach.

🏠 Open Houses: Creating Momentum

Open houses aren’t just about foot traffic — they’re about energy and timing. I take a layered approach:

- I start with an open house for Windermere agents so our 300+ local brokers can preview your home.

- Then I host a weekend open houses to welcome buyers.

- I also participate in the Tuesday Brokers’ Tour to reach agents with active clients.

Each step builds exposure and gives buyers multiple opportunities to fall in love with your home.

🤝 Agent‑to‑Agent Marketing: The Quiet Powerhouse

Some of the most effective marketing happens behind the scenes. I actively promote your listing to:

- My Windermere network

- Thousands of agents across the Portland metro area

- Agents who have buyers searching in your price range or neighborhood

This personal outreach often leads to early showings, stronger offers, and smoother negotiations. It’s one of the most underrated — but most important — parts of the process.

🧩 The Bottom Line

Marketing your home isn’t a single action — it’s a coordinated strategy. By combining strong visuals, broad digital exposure, personal connections, and smart timing, I work to create the kind of momentum that leads to great results.

In Part 6, I’ll walk you through what happens once the offers start coming in and how I help you navigate the negotiation process with clarity and confidence.

Seller Series – Preparing Your Home For Sale – Part 4: Pricing Your Home

So, you’re thinking about selling your home in 2026. Part 4 of my multi-part Seller Series – Preparing Your Home For Sale in 2026 – will give you a view of the multi-faceted process of selling your home. Part 1 focused on Starting Early and Making a First Impression. Part 2 addressed living in your home while selling or marketing the home vacant. Part 3 was all about Staging and Photography.

The Story Behind Pricing Your Home

Every home has a story, and the price we set is the opening line buyers will read. It’s not chosen at random—it’s shaped by a series of conversations, observations, and market realities that together create a strategy.

It begins with location. A home’s neighborhood sets the stage: the schools nearby, the parks within walking distance, the commute options. Buyers don’t just purchase a house—they buy into a lifestyle, and the value reflects that.

Next comes size and usable space. Square footage is the headline number, but buyers look deeper. A finished basement, a flexible office, or an open kitchen can make the same square footage feel far more valuable. Usability often matters as much as raw dimensions.

Condition and age tell another chapter. A home that’s been lovingly maintained, with a newer roof or updated systems, reassures buyers. An older property with deferred maintenance may still shine, but its price needs to account for the work ahead.

Features and amenities add character. A backyard retreat, solar panels, or a chef’s kitchen can set a home apart from others nearby. These details don’t just add comfort—they add perceived value, and buyers notice.

Then there’s the wider market. Supply and demand create the backdrop. When inventory is tight, buyers compete fiercely. When listings are plentiful, pricing must be sharper to stand out, avoiding the temptation to price higher than the market will bear. We also look at the absorption rate – the percentage of homes currently on the market that will sell in the next 30 days. Market trends—interest rates, seasonal rhythms, buyer confidence—shift the tone of the story, and the price adapts with them.

Finally, the seller’s own timeline shapes the ending. A family relocating quickly may choose a price that encourages faster offers. Someone with more flexibility may test higher ranges, waiting for the right buyer. Motivation and timing are as much a part of the equation as square footage or location.

Common Pitfalls in the Pricing Story

Some sellers stumble by letting emotion drive the number, setting a price based on memories rather than market realities. Others ignore early feedback from realtors and their clients, holding firm even when buyers hesitate. Deferred maintenance can be underestimated, leading to surprises during inspections and negotiations. And chasing the market—lowering the price too late—often results in selling for less than if the home had been priced correctly from the start.

The Takeaway

Pricing is both art and science, but above all, it’s a narrative. It weaves together the home’s features, the market’s mood, and the seller’s goals into a single number that speaks to buyers. Done well, it sets the stage for a successful sale and a smooth transition to the next chapter.

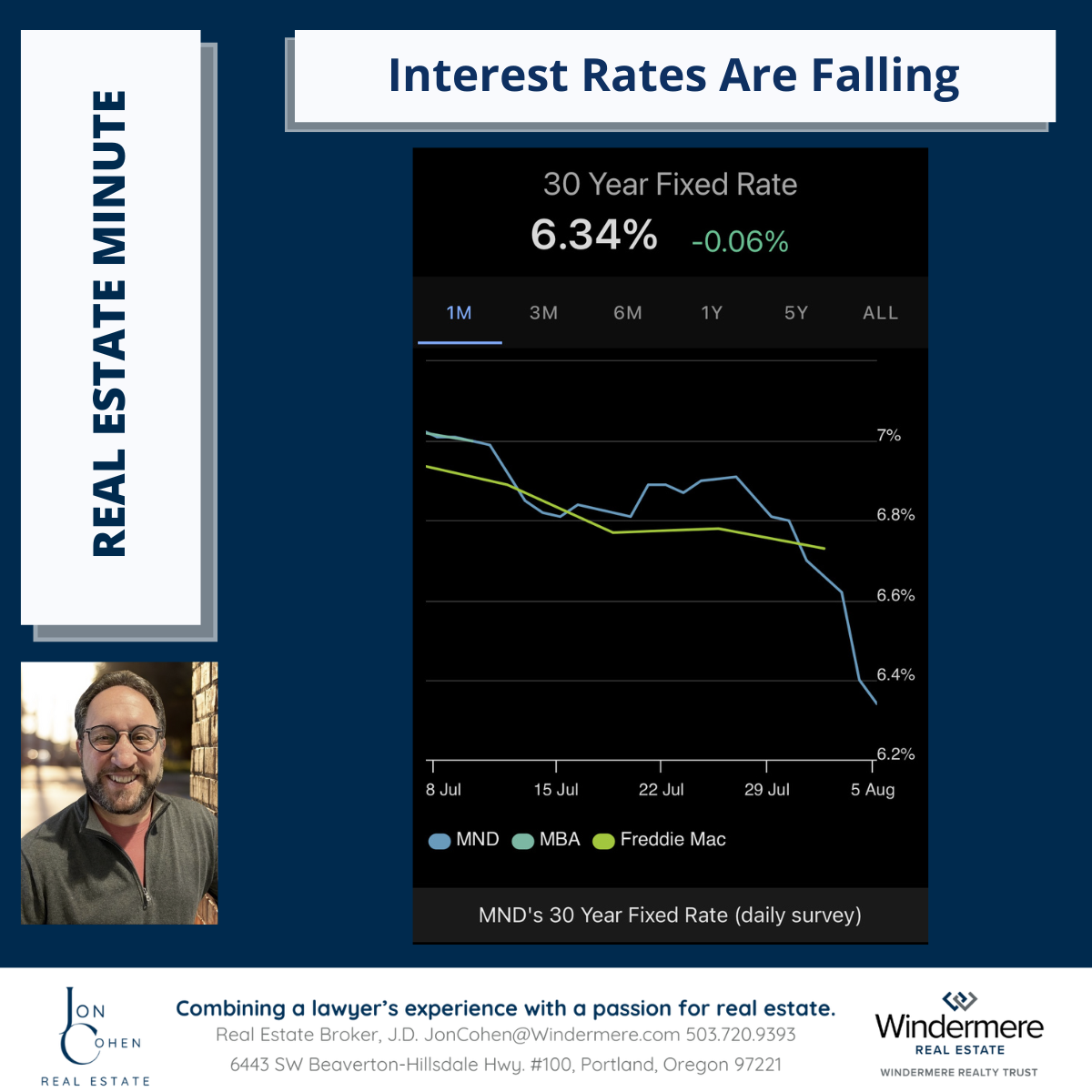

Price Appreciation is Slowing, Mortgage Rates Remain Fickle

As we head into the final stretch of 2025, questions about the economy and housing market are top of mind for many. In this month’s economic update, Windermere Real Estate’s Chief Economist Jeff Tucker unpacks the latest data—from a 4% rise in unemployment claims and the impact of the recent government shutdown, to shifting inventory trends and mortgage rate fluctuations. With home price appreciation slowing to just 1.5% year-over-year and inventory growth tapering off, Jeff offers a clear-eyed look at what these numbers mean for buyers, sellers, and the broader market. Watch the full video to get grounded insights and a forward-looking perspective on what’s next.

Seller Series – Preparing Your Home For Sale in 2026 – Part 3 Staging and Photography

So, you’re thinking about selling your home in 2026. This 5-part Seller Series – Preparing Your Home For Sale in 2026 – will give you a view of the multi-faceted process of selling your home. Part 1 focused on Starting Early and Making a First Impression. Part 2 addressed living in your home while marketing your home vacant.

Remember, it’s all about first impressions.

In today’s real estate market, your home’s first showing doesn’t happen at the front door—it happens online. That means staging and photography aren’t just aesthetic choices; they’re strategic tools that can make or break a buyer’s interest before they ever step inside.

Staging is about storytelling. It’s not just arranging furniture—it’s creating a mood, a lifestyle, a sense of possibility. A well-staged living room invites conversation. A thoughtfully styled bedroom whispers rest and retreat. Even small touches—a bowl of fresh fruit, a cozy throw, a vase of flowers—can evoke warmth and aspiration. The goal is to help buyers see not just the space, but themselves in it.

Photography, meanwhile, is your home’s handshake with the world. Professional photos capture light, scale, and flow in ways that smartphone snapshots simply can’t. They highlight the home’s strengths and minimize distractions. Timing matters too—natural light can transform a room, so scheduling your shoot for mid-morning or late afternoon can make a big difference.

It’s also worth noting that staging for photography isn’t quite the same as staging for in-person showings. The camera sees differently than the human eye. What looks balanced in real life might feel cluttered in a photo. Rugs, for instance, can break up visual flow on camera, and open blinds often make a room feel brighter and more spacious.

For homes with unique layouts or out-of-town buyers, consider adding a virtual tour or a short walkthrough video. My visual package includes a 3-D walkthrough as well as a short video. These tools offer a deeper sense of the home’s flow and can help buyers connect emotionally even from afar.

Ultimately, staging and photography are about creating connection. They invite buyers to imagine their future—and that’s what sells homes.

Seller Series – Preparing Your Home For Sale in 2026 – Part 2: Occupied or Vacant?

So, you’re thinking about selling your home in 2026. This 5-part Seller Series – Preparing Your Home For Sale in 2026 – will give you a view of the multi-faceted process of selling your home. Part 1 focused on Starting Early and Making a First Impression.

Now that your home is looking its best…

One of the first decisions a homeowner faces when preparing to sell is whether to list the property while still living in it or to move out and present it vacant. It’s not just a logistical choice—it can shape how buyers perceive the home, how easily it can be shown, and how much emotional bandwidth the process demands. Of course, not all sellers are in a position to move before selling their current home.

Selling an occupied home has its advantages. It can feel warm and lived-in, which helps buyers imagine themselves settling in. There’s also the financial upside: you’re not juggling two housing payments or scrambling for temporary accommodations. And from a practical standpoint, an occupied home is less likely to suffer from neglect or security issues.

But there’s a tradeoff. Living in a home that’s “on the market” can feel like living in a museum. You’ll be tidying constantly, coordinating showings around your schedule, and trying to keep personal items tucked away. For some sellers, especially families or pet owners, this can be exhausting.

Vacant homes offer a different kind of freedom. Showings are easier to schedule, and professional staging can transform the space into a buyer’s dream. Without the clutter of daily life, the home can shine in photos and walkthroughs. Yet vacant homes can also feel cold or impersonal if not thoughtfully staged. And they come with added costs—utilities, upkeep, and sometimes staging fees.

There’s no one-size-fits-all answer. Some sellers opt for a hybrid approach: they move out but leave behind a few key pieces of furniture, or they stay put but stage select rooms to highlight the home’s best features. The goal is to strike a balance between livability and marketability—making it easy for buyers to fall in love while keeping your own life manageable.

Seller Series – Preparing Your Home For Sale in 2026 – Part One: You Never Get a Second Chance to Make a First Impression

So, you’re thinking about selling your home in 2026. The best time to start preparing is right now. Properly preparing your property for sale takes time, and that time passes quickly. The phases of preparation range from decluttering your home and removing many of the clothes you don’t need from your closets, to tackling those repair issues you’ve been ignoring for years. The goal is to make your house the most attractive house on the market in your price range. This 5-part Seller Series – Preparing Your Home For Sale in 2026 – will give you a view of the multi-faceted process of selling your home.

Time is your friend

You cannot control which neighborhood houses will be on the market, or how many buyers will be actively shopping your neighborhood, when your time to list comes around. The trick is to make your house look more attractive than anything else on the market at go time. Starting early gives you plenty of time to identify the projects and find the professionals to help complete those projects. The sooner you start the process, the less stress you create as you get closer to your listing date.

Step One – Let’s Talk Preparation

As your real estate advisor, one of my jobs is to help you prepare your house for sale by identifying the projects that should be done and those that can be done if you choose, all within your budget.

“You never get a second chance to make a first impression.”

That old adage is the basis of my advice to create a great first impression for buyers when they see your home online and in person. That impression starts at the street, works its way up to the front door, and then peaks when they open the front door. Landscaping and tree trimming, pressure washing, painting, repairing front steps and porches, cleaning and staging the inside of the house.

Then we get to look under the hood. I have experienced many inspections over the years as a representative of both buyers and sellers. I know the issues that home inspectors are likely to identify, and which issues are likely to be the subject of negotiations prior to closing a sale.

The items that come up frequently are furnaces, air conditioners, water heaters and roofs. The issues that are often the most surprising are the ones you can’t see. These include: the condition of the sewer line; mold in the attic or crawl space; and crawl space issues like water intrusion, rodents, poor vapor barrier and/or insulation, and radon. Identifying and correcting these types of issues before you list your home for sale will go a long way toward avoiding a difficult post-inspection negotiation.

Let the home inspectors find little items to address, but don’t let them surprise you with major repairs or discoveries that may scare off buyers and prolong the time your house takes to sell.

As you contemplate selling your home, let’s talk about preparing your home for sale and the time it will take to do it right.

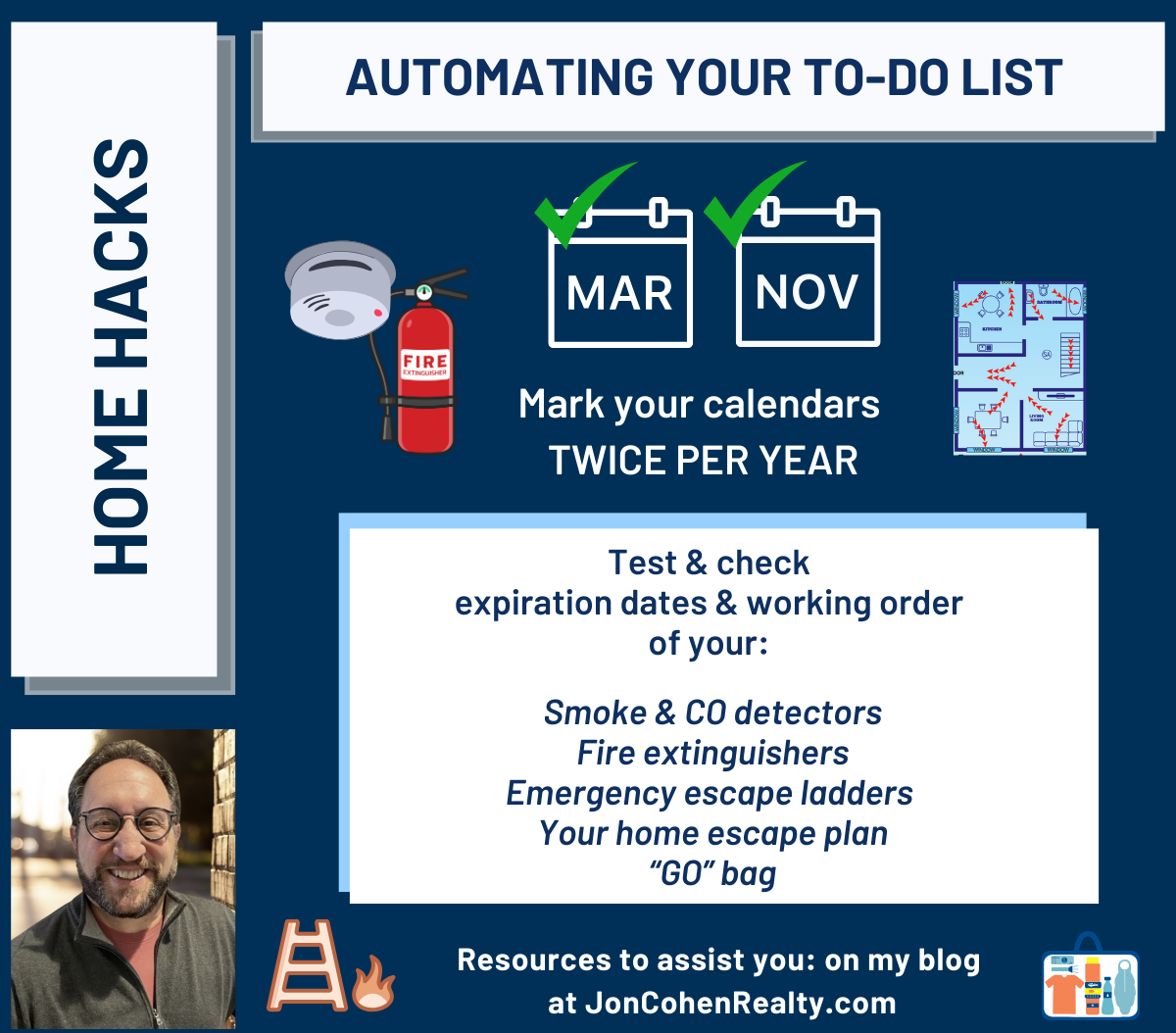

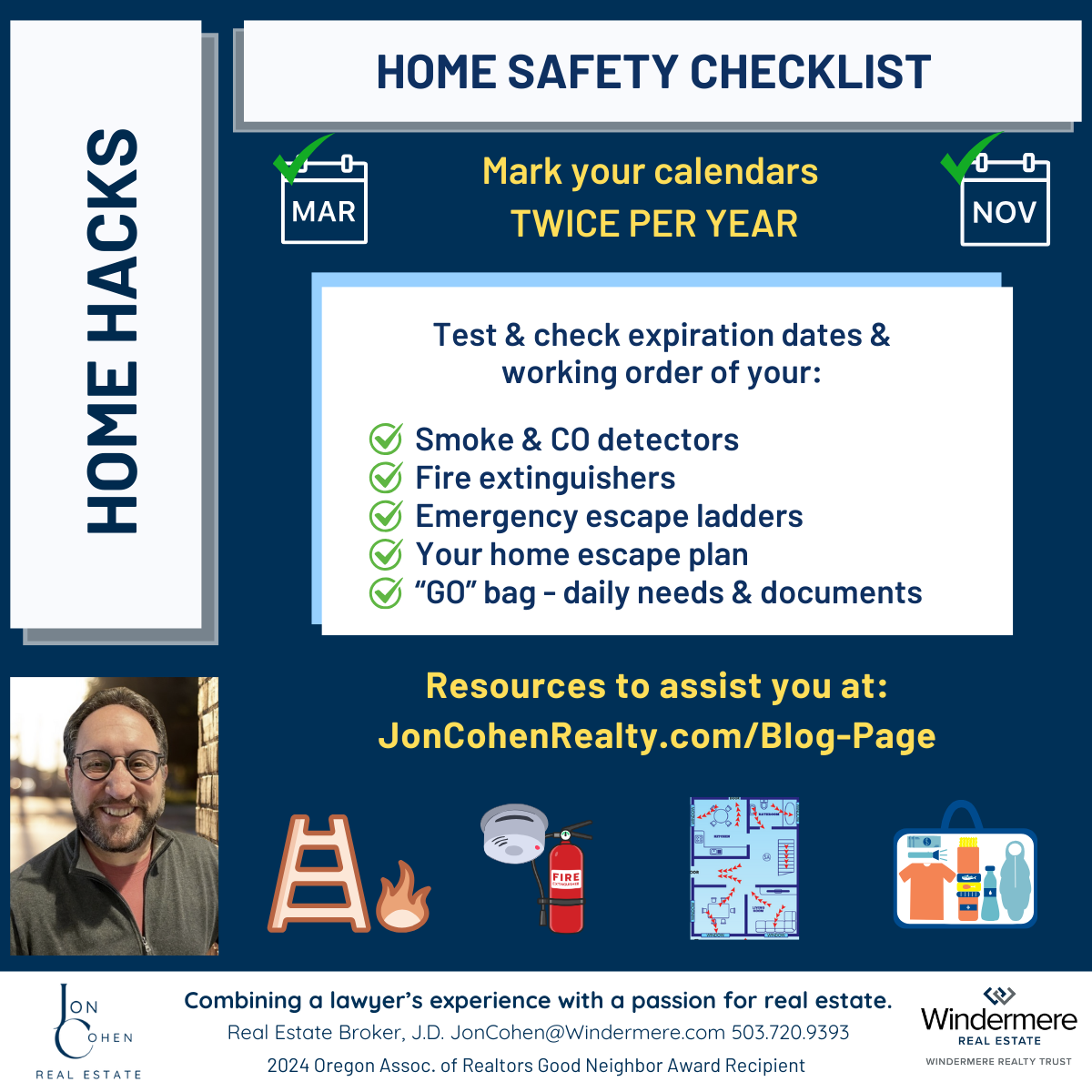

Your Home Safety Checklist

Your Ultimate Home Safety Checklist

Ensuring the safety and well-being of your family is a top priority, and taking proactive steps to prepare for emergencies can make all the difference in protecting your loved ones and your home. Here’s a home safety checklist to help ensure you’re well-prepared for any situation.

1. Check Smoke and Carbon Monoxide Detectors

Smoke and carbon monoxide detectors are your first line of defense against fire and gas emergencies.

- Test alarms regularly, at least once a month.

- Replace batteries annually or when the low-battery warning chirps.

- Ensure there’s a detector on every level of your home, including the basement.

- Replace detectors every ten years or as recommended by the manufacturer.

2. Inspect Fire Extinguishers

Fire extinguishers can help control small fires before they become big emergencies.

- Make sure extinguishers are easily accessible and not blocked by furniture or other items.

- Check the pressure gauge to ensure the extinguisher is fully charged.

- Ensure the extinguisher is not more than ten years old.

- Confirm you have the correct type of extinguisher for different areas (e.g., kitchen, garage).

3. Create or Practice Your Home Escape Plan

Having a well-practiced escape plan can save precious seconds during an emergency.

- Draw a floor plan of your home, marking all exits and escape routes.

- Designate a safe meeting place outside your home where everyone will gather.

- Ensure all family members know how to exit safely from each room, even in the dark or smoke.

- Practice your escape plan twice a year, including the placement and use of emergency escape ladders on upper floors.

4. Prepare Your “Go Bag”

A “Go Bag” ensures you have essential supplies ready to go at a moment’s notice.

- Pack a three-day supply of non-perishable food and water (one gallon per person per day).

- Include medications, personal hygiene items, and basic first-aid supplies.

- Pack important documents such as identification (ID cards, passports), insurance policies, and financial records.

- Include items like flashlights, batteries, a multi-tool, blankets, and a whistle.

5. Necessary Documents for Emergencies

Keep important documents in a safe, easily accessible location, or have electronic copies available.

- Personal identification: driver’s licenses, passports, Social Security cards.

- Property records: deeds, titles, rental agreements, mortgage documents.

- Financial records: bank account information, credit card statements, tax returns.

- Medical information: health insurance cards, medical records, prescriptions.

- Legal documents: wills, powers of attorney, birth and marriage certificates.

By taking these proactive steps, you can ensure your home is prepared for emergencies and your loved ones are safe. Remember, regular maintenance and practice are key to effective home safety. Stay vigilant and keep this checklist handy to make sure you’re always ready for the unexpected. Stay safe! 🏡🔒

Your Phone Can Save Your Life

After a recent life-threatening medical event in our family, I want to share this important information to help you be better prepared. If you, your family, or friends are unable to communicate with emergency personnel—whether unconscious or otherwise incapacitated—it can be extremely difficult for responders to understand your medical conditions, allergies, medications, and emergency contacts. This can delay critical care and hinder their ability to reach the right people who can speak on your behalf. However, if this vital information is stored and updated on your phone, first responders can access it, even if your phone is locked, allowing them to provide timely treatment and potentially save your life.

Here are instructions to add this crucial information to your iPhone or Android phone:

For an iPhone:

For an Android phone:

TIP: Set a recurring date on your calendar to review and update your Medical ID entries every quarter, as any of this information may change (especially medications), and it is critically important that medical personnel are aware of potential drug interactions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link